Key Takeaways:

- Chinese Pokémon TCG market shows unprecedented growth patterns

- English cards demonstrate stable, long-term appreciation

- Japanese market remains volatile but strategically important

- All three markets now entering critical growth phases

A New Contender Emerges

When Pokémon TCG officially launched in China in late 2022, it created an entirely new collecting landscape. The Latias & Latios GX card provides particularly valuable insights, with versions available across all three major markets – English (2019), Japanese (2018), and now Simplified Chinese (2023).

Growth Patterns Tell the Story

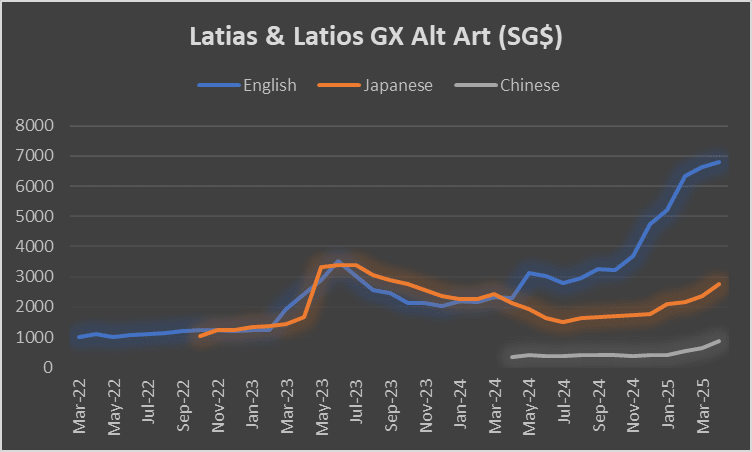

Our tracking of available market data reveals distinct trajectories:

- English Market (+577% since 2022)

The steady climber, showing consistent appreciation with less volatility. This reflects mature market dynamics where collectors prioritize long-term holds.

- English Market (+577% since 2022)

- Japanese Market (+170% with significant swings)

Peaked dramatically in 2023 before correcting, demonstrating the volatility of a market driven by both collectors and speculators.

- Japanese Market (+170% with significant swings)

- Chinese Market (+151% in just one year)

The newcomer showing the most explosive growth, potentially compressing years of typical appreciation into a much shorter timeframe.

- Chinese Market (+151% in just one year)

Why This Matters for Collectors

Several critical factors emerge from this comparison:

- The “two-year rule” appears to hold – cards typically accelerate in value after this period when reprint risks diminish

- Market maturity significantly affects price stability

- New markets may offer different risk/reward profiles for strategic collectors

Strategic Considerations

For those building or managing collections, this analysis suggests:

- English cards may represent the “blue chip” option

- Japanese versions offer trading opportunities but require timing

- Chinese cards present an intriguing growth story, though with less historical precedent